Your Council Tax 2024-2025 explained

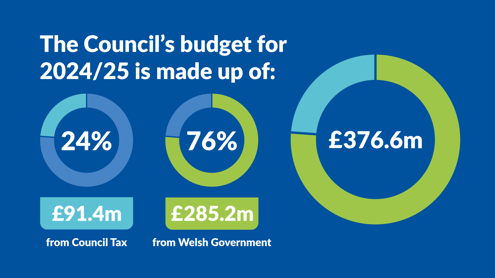

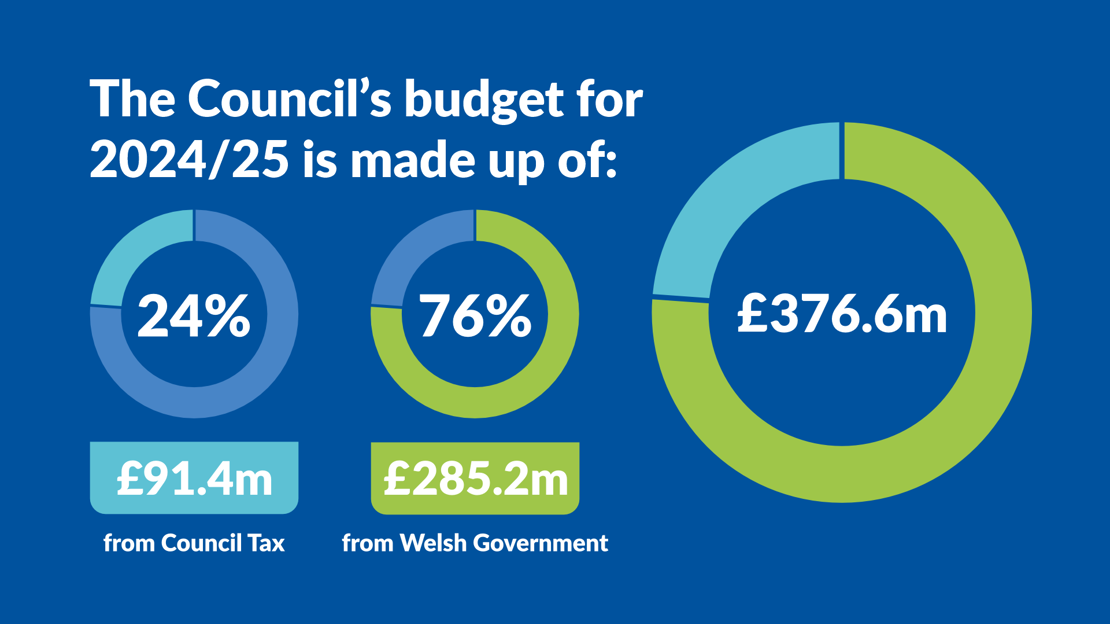

The Council Tax you pay is not calculated based on which services you receive or use. It contributes around a quarter to the budget the Council needs to provide vital services to residents and businesses.

The council’s funding comes from two main sources:

- Welsh Government grants

- Council Tax

This is how the 2024-25 budget is made up:

Council Tax levels 2024-25

The Council Tax increase for this year is 7.9%.

That’s an average increase of £2.25 per week, made up as follows:

- payment to Mid & West Wales Fire and Rescue Service - 1.24%

- subsidy to Celtic Leisure to run indoor leisure services - 2.00%

- contribution to the cost of running council services - 4.66%

Here is a breakdown of the increase for each property band:

| Property band | Number of households in this band | Weekly Council Tax increase per household |

|---|---|---|

| A | 13,344 | £1.76 |

| B | 26,416 | £2.05 |

| C | 11,387 | £2.34 |

| D | 7,195 | £2.64 |

| E | 4,358 | £3.22 |

| F | 1,353 | £3.81 |

| G | 529 | £4.39 |

| H | 95 | £5.27 |

| I | 14 | £6.15 |