Proposed Council Tax increase for 2026-2027

The consultation on the proposal to increase council tax by 3.5% in Neath Port Talbot has now closed. Thank you to everyone who responded.

Next steps

A report asking for approval to set next year’s budget is due to be presented to Cabinet on Wednesday 4 March and Full Council on Thursday 5 March.

When published the report will be available here.

The draft budget

All councils have to deliver a balanced budget by law, and NPT Council has published draft budget proposals for next year.

Even at a time of continuing financial pressures, we aim to deliver a budget that will see a record investment in schools and millions of pounds for other vital front-line services such as maintaining roads and social services.

The draft budget for 2026-2027 for NPT includes an extra £7 million to support pupils with additional learning needs.

A further £330,000 has been allocated for building maintenance, including work on school facilities.

Some of the other key investments proposed include:

- £100,000 for the maintenance of playgrounds, supporting the £2.5 million Playground Improvement Programme announced last year

- £170,000 to improve the management of Aberavon Seafront, including a programme of activities

- £200,000 for the Countryside and Wildlife team to maintain public rights of way

- £4.768 million to support adults and children with additional care needs.

You can read full details of the draft budget proposals in the Cabinet Report - 2026-2027 Revenue Budget Proposals (Appendix 4) or in reference copies available at:

- Port Talbot Civic Centre

- Neath Civic Centre

- libraries across NPT

The budget gap

Whilst we welcome an increase of 4.2% in funding from Welsh Government for next year (the all-Wales average increase is 4.5% with NPT ranked joint 12th/17th out of the 22 Welsh local authorities) it still leaves a budget shortfall of £16.623 million.

The council has managed to reduce this shortfall to £2.802 million because of changes to the Local Government Pension Scheme contribution and thanks to the identification of more than 40 savings and income generation proposals. These will not result in significant service or policy changes, so they are not part of the consultation. They include improvements in leisure, arts, and environmental services, as well as invest-to-save projects in areas such as energy efficiency and utilities.

To close the remaining gap and continue protecting essential services, the council is proposing a 3.5% Council Tax increase for 2026-2027. This would be equivalent to an average of £1.15 per week and would represent the lowest increase in recent years.

Council Tax

Here is some information on Council Tax in NPT for the current financial year (2025-2026) and how it is spent. This has been provided to help you consider how far you agree with the proposal to increase Council Tax by 3.5% next year.

The Council Tax you pay is not calculated based on which services you receive or use. It is charged to the household, based on the value of the property. Council Tax contributes around a quarter of the budget the council needs to provide vital services to residents and businesses.

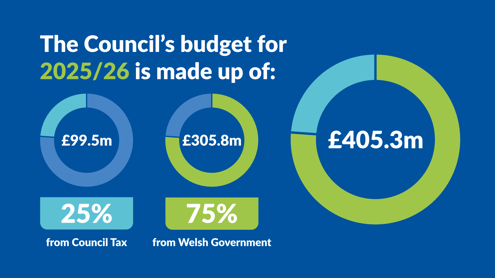

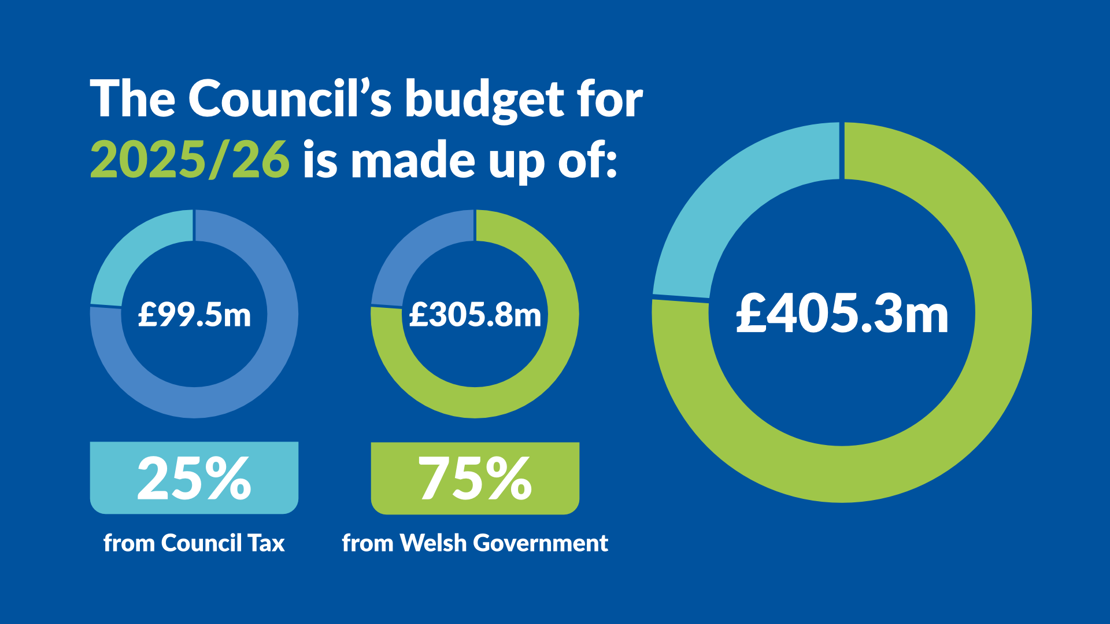

The council’s funding comes from two main sources - Welsh Government grants and Council Tax. This is how the budget for the current financial year (2025-2026) is made up:

A 3.5% increase in Council Tax would be equivalent to the following per week:

| Band | Weekly increase |

|---|---|

| A | £0.90 |

| B | £1.05 |

| C | £1.20 |

| D | £1.35 |

| E | £1.65 |

| F | £1.95 |

| G | £2.25 |

| H | £2.70 |

| I | £3.15 |

Although it is called Council Tax, the amount you are charged doesn’t all come to Neath Port Talbot Council. It also includes charges for services provided by other organisations. The council works as a collecting agent and collects these charges on their behalf. We have no control over these charges.

The organisations that we collect for will be shown on your Council Tax bill, they are:

- the charge for the Police and Crime Commissioner for South Wales

- a charge for your Town or Community Council, if you live in an area which has one

Where Council Tax goes

The graphic on the right shows a detailed breakdown for the current financial year (2025-2026) of how your Council Tax helps deliver services in NPT.

This is based on a Band D charge which is £2,002.78.

The Band D Council Tax charge is used as a reference point to set Council Tax for all other bands. However, around 51,000 properties in Neath Port Talbot (79%), are in bands A, B and C. This means that the average Council Tax for the county borough is £1,907.17.

Council Tax support

The council has a Council Tax Support Scheme which helps eligible households reduce their bills.

If you are on a low income or getting benefits including Universal Credit, you may be entitled to Council Tax Support.

In 2025-26, from a total of just over 67,000 households in Neath Port Talbot, 15,200 receive Council Tax Support. Out of the 15,200:

- 12,400 pay no Council Tax

- around 2,800 only pay a partial amount

Council Tax Support is means-tested. This means those who need it most receive it.

The alternative to a Council Tax increase

For every 1% reduction in Council Tax, the council would need to find an extra £800,000.

The alternative to increasing Council Tax would be cuts to vital frontline services that people rely on every day. This includes things like:

- maintaining roads

- bin collections

- looking after vulnerable children and adults

Council reserves

We are often asked if the council’s reserves can be used to balance the budget. To keep reserves at the lowest level in the General Reserves Policy (i.e. 4% of the net revenue budget), there is little scope to use them to support the 2026-27 budget proposals.

Welsh language impact

The council is committed to the principles that the Welsh language is treated no less favourably than the English language. A Welsh language Impact Assessment will be undertaken following the consultation.